Federal, State and, Local Credits & Rebates

Federal Solar Tax Credit

ITC allows businesses and homeowners to deduct a portion of their solar costs from their taxes. In 2019 the ITC is 30% and will go down to 26% in 2020 and will go down further after that. For more information about the ITC and the timeline for its eventual end in 2022.go to: federal solar tax credit

California Solar Initiative Rebates

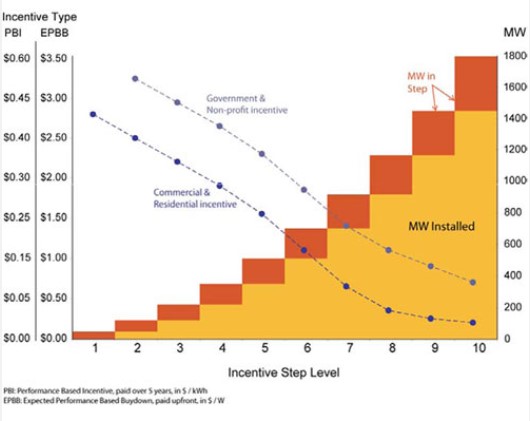

California Solar Initiative rebates vary according to utility territory, system size, customer class, and performance and installation factors. The rebates automatically decline in “steps” based on the volume of solar megawatts (MWs) with confirmed project reservations within each utility service territory. The figure below shows the expected schedule for rebate decline over time. To find the currently applicable rebate level in your area, check with your local utility administrator. There are two incentive paths available to consumers: Expected Performance Based Buy-down and Performance Based Incentive.

For more info, go to: SolarEquipment@energy.ca.gov

Cash Rebates

It is sometimes possible to receive a cash rebate from your state, municipality, utility company, or other organization that wants to promote solar energy. Rebates are generally available for a limited time and end once a certain amount of solar has been installed. Rebates can help to further reduce your system costs by 10 to 20 percent.

951-545-2678

CALL US TODAY TO UNLOCK YOUR SAVINGS

sales@firstenergysystems.com

1101 California Ave, #100, Corona CA, 92881